If you stay too close to her, she’ll run.īut if you give her space, you’ve got better odds of winning her over. When it comes to riding trends, even with the 50 day EMA, many traders get stopped out on the slightest pullback.īecause they trail their stop loss too tight!

#Ema stock meaning how to

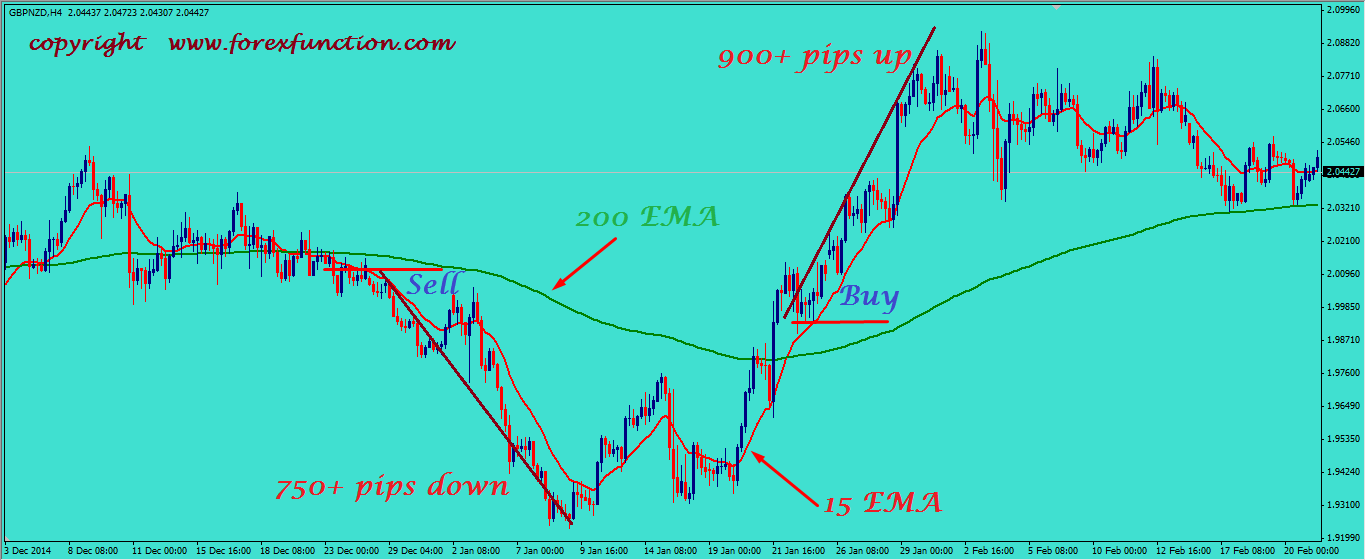

(Also, it’s normal for the price to exceed the 50 MA as we are identifying an area of value, not a specific price level.)Īnd after the price re-tests the 50 day moving average, you can use reversal candlestick patterns (like Hammer or Bullish Engulfing Pattern) to time your entry.įor now, let’s move on… How to use the 50 day moving average to ride massive trends (and not get stopped out on minor pullbacks) Let’s look at the same chart earlier but this time, overlay with the 50 day moving average… Well, you need to find a new area of value - and that’s where the 50 day moving average comes into play. Is there a 50 EMA trading strategy for it? So, how do you trade in such a market condition? The market doesn’t re-test Support and if that’s what you’re looking for, you’ll be on the sidelines for a long time (while the market continues higher without you). Now, this EMA trading strategy is useful when the market is in a range or a weak trend.īut what if the market is in a trend like this? Most traders are familiar with buying Support and selling Resistance. How to use the 50 day moving average and identify profitable trading opportunities Of course, you don’t have to do it manually because all trading platforms allow you to add the 50 day moving average to your chart.Īnd here’s how it looks like: A 50 day moving average on the chartĪ Golden Cross occurs when the 50 day moving average crosses above the 200-day moving average. This means the 5 day moving average is currently at $98Īnd when you add these 5 period MA values together, you get a smooth line on your chart.Īll you need to do is add the closing price over the last 50 days and divide by 50, that’s it. So, the average price over the last 5 days is: Over the last 5 days, Google had a closing price of 100, 90, 95, 105, and 100. The Moving Average (MA) is a technical indicator that averages out the historical prices. Well, there’s no best moving average out there because it doesn’t exist (as it depends on your objective current market structure).īut in a healthy trend, the 50 day moving average is king.Īnd that’s what you’ll discover in today’s post, so read on… What is 50 day moving average and how does it work?

“What is the best combination of an EMA trading strategy?”

You’ve got the 50 day moving average, 100 day moving average, 200 day moving average, etc.

There are endless possibilities when it comes to moving average. The 50 Day Moving Average Trading Strategy Guide

0 kommentar(er)

0 kommentar(er)